UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x☒ Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Under Rule 14a-12 | ||

Aqua America, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. | ||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| Fee paid previously with preliminary materials: | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||||

| 1) | Amount previously paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

AQUA AMERICA, INC.

20162017 ANNUAL MEETING OF SHAREHOLDERS

Christopher H. Franklin President | LETTER TO OUR SHAREHOLDERS

Dear Fellow Shareholder,

We

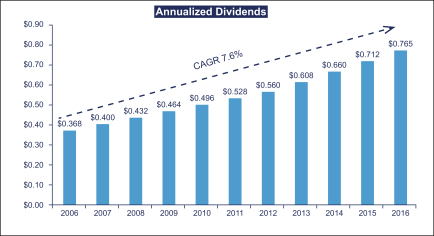

We plan to continue our ongoing commitment to maintaining a |

The new leadershipMy team established in 2015, experienced a numberand I will speak more about these topics at the Annual Meeting. In the meantime, I would like to share the following list of notable accomplishments:accomplishments our company has experienced during 2016—the year of our 130th anniversary:

*2015 income from continuing operations per share was $1.14; adjusted income isSee Appendix B for a reconciliation of non-GAAP financial measure that excludes Aqua’s share of a noncash joint venture impairment charge.measures to GAAP financial measures.

Speaking on behalf of the entire new leadership team, we remain focused on investing in upgrading aging infrastructure, supporting the communities we serve, continuing to add customer connections through prudent acquisitions to share our financial strength and operational expertise with new communities, and refining and developing our market-based operations – all to provide shareholder value. I am honored to serve as the new presidentPresident and CEOChief Executive Officer of Aqua America, Inc.,what I believe is the best water and wastewater company in the nation, and I look forward to seeing you at our annual meetingAnnual Meeting in May.

Sincerely,

AQUA AMERICA, INC.

762 W. Lancaster Avenue

Bryn Mawr, Pennsylvania 19010

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Friday,Wednesday, May 6, 20163, 2017 at 8:30 A.M. local time

The Annual Meeting of Shareholders of AQUA AMERICA, INC. (the “Company”) will be held at theDrexelbrook Banquet Facility & Corporate Events Center, 4700 Drexelbrook Drive, Drexel Hill, PA 19026onFridayWednesday,May 6, 2016 3, 2017, at8:30 A.M., local time, for the following purposes:

| 1. | To consider and take action on the election of eight nominees for directors; |

| 2. | To consider and take action on the ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for the |

| 3. | To |

| 4. | To approve an advisory vote on whether the frequency of the advisory vote on the compensation paid to the Company’s named executive officers should be every 1, 2 or 3 years; and |

| To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on March 7, 20162017 will be entitled to notice of, and to vote at, the meeting and at any adjournments or postponements thereof.

By Order of the Board of Directors,

CHRISTOPHER P. LUNING

Secretary

March 23, 201624, 2017

We urge each shareholder to promptly sign and return the enclosed proxy card or to use telephone or internet voting. See our questions and answers about the meeting and the voting section of the proxy statement for information about voting by telephone or internet, how to revoke a proxy and how to vote your shares in person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 6, 20163, 2017

The Notice of Annual Meeting, Proxy Statement and 20152016 Annual Report to Shareholders

are available at: http://ir.aquaamerica.com/

AQUA AMERICA, INC.

762 W. Lancaster Avenue, Bryn Mawr, Pennsylvania 19010

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Aqua America, Inc. (“Aqua America”, “Aqua” or the “Company”) to be used at the Annual Meeting of Shareholders to be held on Friday,Wednesday, May 6, 20163, 2017 at 8.30 a.m., local time, and at any adjournments or postponements thereof (“20162017 Annual Meeting” or the “meeting”).

The cost of soliciting proxies will be paid by the Company, which has arranged for reimbursement at the rate suggested by the New York Stock Exchange (the “NYSE”) of brokerage houses, nominees, custodians and fiduciaries for the forwarding of proxy materials to the beneficial owners of shares held of record. In addition, the Company has retained Alliance Advisors LLC to assist in the solicitation of proxies from (i) brokers, bank nominees and other institutional holders, and (ii) individual holders of record. The fee paid to Alliance Advisors LLC for normal proxy solicitation does not exceed $7,000$7,500 plus expenses, which will be paid by the Company. Directors, officers and regular employees of the Company may solicit proxies, although no compensation will be paid by the Company for such efforts.

Under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), the Company is now furnishing proxy materials to many of its shareholders on the Internet, rather than mailing printed copies of those materials to each shareholder. If you received a notice of availability over the Internet of the proxy materials (“Notice”) by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice will instruct you as to how you may access and review the proxy materials on the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice. The Notice is being sent to shareholders of record as of March 7, 20162017 on or about March 25, 2016.24, 2017. Proxy materials, which include the Notice of Annual Meeting of Shareholders, this Proxy Statement and the Annual Report to Shareholders for the year ended December 31, 2015,2016, including financial statements and other information with respect to the Company and its subsidiaries (the “Annual Report”), are first being made available to shareholders of record as of March 7, 2016,2017, on or about March 25, 2016.24, 2017. Additional copies of the Annual Report may be obtained by writing to the Company at the address and in the manner set forth under “Additional Information” on page 72.70.

As the meeting is the Annual Meeting of Shareholders, the shareholders of the Company will be requested to:

|

1 |

QUESTIONS AND ANSWERS ABOUT THE 20162017 ANNUAL MEETING

Who is entitled to vote?

Holders of shares of the Company’s Common Stockcommon stock (the “Common Stock”) of record at the close of business on March 7, 20162017 are entitled to vote at the meeting.

Each shareholder entitled to vote shall have the right to one vote on each matter presented at the meeting for each share of Common Stock outstanding in such shareholder’s name.

How many shares can vote?

As of March 7, 2016,2017, there were 177,218,592177,567,809 shares of Common Stock outstanding and entitled to be voted at the meeting.

How do I cast my vote?

Shares can be voted in the following four ways:

What is the proxy?

The proxy card or electronic proxy that you are being asked to give is a means by which a shareholder may authorize the voting of his or her shares at the meeting if he or she is unable to attend in person. The individuals to whom you are giving a proxy to vote your shares are Christopher P. Luning, our senior vice president, general counselSenior Vice President, General Counsel and secretary,Secretary, and David P. Smeltzer, our executive vice presidentExecutive Vice President and chief financial officer.Chief Financial Officer.

The shares of Common Stock represented by each properly executed proxy card or electronic proxy will be voted at the meeting in accordance with each

shareholder’s direction. Shareholders are urged to specify their choices by marking the appropriate boxes on the proxy card or electronic proxy, or voting via telephone. If the proxy card or electronic proxy is signed, but no choice has been specified, the shares will be voted as recommended by the Board of Directors. If any other matters are properly presented at the meeting or any adjournment or postponement thereof for action, the proxy holders will vote the proxies (which confer discretionary authority to vote on such matters) in accordance with their judgment.

If a proxy is executed, can a shareholder still attend the meeting in person?

Yes. Execution of the accompanying proxy or voting through an electronic proxy or voting by telephone will not affect a shareholder’s right to

attend the meeting and, if desired, vote in person. You can submit a proxy and still attend the meeting without voting in person.

Can a shareholder revoke or change his or her vote?

Yes. Any shareholder giving a proxy card or voting by electronic proxy or voting by telephone has the right to revoke the proxy or the electronic or telephonic vote by giving written notice of revocation to the Secretary of the Company at any time before

the proxy is voted, by executing a proxy

bearing a later date, by making a later-dated vote electronically or by telephone, or by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a previously granted proxy.

|

2 |

What are the voting requirements for the Board of Directors to take action onapprove the proposals discussedpresented in the Proxy Statement?

The Company’s Articles of Incorporation and Bylaws, as amended, provide that the affirmative vote of a majority of the votes cast by those shareholders present in person or represented by proxy at the meeting is required to take action with respect to any matter properly brought before the meeting, other than the election of directors, on the recommendation of a vote of a majority of the entire Board of Directors.Directors (i.e., Proposals 2, 3, and 4). Abstentions and brokernon-votes, if any, will have

no effect with respect to such

matters, other than for purposes of determining the presence of a quorum.

The Company’s Bylaws also provide that the affirmative vote of at least three quarters of the votes which all voting shareholders, voting as a single class, are entitled to cast is required to take action with respect to any other matter properly brought before the meeting, other than the election of directors, without the recommendation of a vote of a majority of the entire Board of Directors.

What is a quorum?

A quorum of shareholders is necessary to hold a valid meeting of shareholders for the transaction of business. The holders of a majority of the shares entitled to vote, present in person or represented by

proxy at the meeting, constitute a quorum. Abstentions and “brokernon-votes” are counted as present and entitled to vote for purposes of determining a quorum.

What is a brokernon-vote?

A “brokernon-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power under NYSE rules for that particular item and has not received instructions from the beneficial owner.

If you are a beneficial owner, your bank, broker or other holder of record is permitted under NYSE rules to vote your shares on the ratification of

PricewaterhouseCoopers LLP as our independent

registered public accounting firm for the 2016 fiscal year, even if the record holder does not receive voting instructions from you. The record holder may not vote on the election of directors, or the advisory vote on the compensation paid to the Company’s named executive officers for 20152016 or the advisory vote on the frequency of the advisory vote on the compensation paid to the Company’s named executive officers without instructions from you. Without your voting instructions on these matters, a brokernon-vote will occur.

YOUR PROXY VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE ASKED TO COMPLETE, SIGN AND RETURN THE PROXY CARD OR SUBMIT AN ELECTRONIC PROXY, VOTE TELEPHONICALLY OR PROVIDE YOUR BROKER WITH INSTRUCTIONS ON HOW TO VOTE YOUR SHARES, REGARDLESS OF WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

|

3 |

PROPOSALS UNDER CONSIDERATION AT THIS MEETING

How are directors elected?

Under the Company’s Articles of Incorporation and Bylaws, directors are elected by a plurality of the votes cast at the meeting. A description of the Company’s majority voting resignation policy is set forth in the answer to the question below. Votes may be cast FOR or WITHHOLD for each nominee. Brokernon-votes will be excluded entirely from the vote to elect directors and will have no effect, other

than for purposes of

determining the presence of a quorum. Abstentions will have no effect on the election of directors. The director nominees who receive the highest number of votes up to the number of directors to be elected will be elected at the meeting. All of the directors elected at the 20162017 Annual Meeting will be elected for one year terms expiring at the 20172018 Annual Meeting and until their successors are duly elected and qualified.

What if an incumbent director receives more WITHHOLD votes than FOR votes in an uncontested election?

In 2011, the Board of Directors adopted a majority voting resignation policy for the election of directors in uncontested elections. Under this policy, in an election where the only nominees are those recommended by the Board of Directors, any incumbent director who is nominated forre-election and who receives a greater number of WITHHOLD votes than FOR votes for the director’s election shall promptly tender his or her resignation to the Board of Directors. The Board shall evaluate the relevant facts and circumstances in connection with such director’s resignation, giving due consideration to the best interests of the Company and its shareholders. Within 90 days after the election, the independent directors shall make a decision on whether to accept or reject the tendered resignation, or whether other action should be taken. The Board of Directors

of Directors will promptly disclose publicly its decision and the reasons for its decision.

The Board of Directors believes that this process enhances accountability to shareholders and responsiveness to shareholder votes, while allowing the Board of Directors appropriate discretion in considering whether a particular director’s resignation would be in the best interests of the Company and its shareholders.

The Company’s majority voting resignation policy is set forth in the Company’s Corporate Governance Guidelines. Copies of the Corporate Governance Guidelines can be obtained free of charge from the Corporate Governance portion of the Investor Relations section of the Company’s website,www.aquaamerica.com.

Why are the shareholders asked to vote on the ratification of the selection of the independent registered public accounting firm?

The Audit Committee of our Board of Directors carefully considers the qualifications of the independent auditors before engaging them to conduct an audit, and has the oversight authority with respect to the performance of the independent auditors. The Board of Directors thinks it is important to provide an opportunity for the shareholders to voice any concern with respect to the independent auditors selected, which is the reason for this ratification vote. Under the

Company’s Articles of Incorporation and Bylaws, the

affirmative vote of a majority of the votes cast by those shareholders present in person or by proxy at the meeting is required to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company for the 20162017 fiscal year. Abstentions will not be considered votes cast on this proposal and, therefore, will have no effect, other than for purposes of determining the presence of a quorum.

|

|

What is the impact of the advisory vote on the compensation paid to the Company’s named executive officers?officers, referred to as “Say on Pay” vote?

The Board of Directors and the Executive Compensation Committee, which is comprised of independent directors, value the opinions of the Company’s shareholders and expect to take into

account the outcome of thenon-binding advisory

vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results.

4 |

Why are shareholders being asked to provide an advisory vote on the frequency of how often the Say on Pay vote will be submitted to shareholders in future years?

The Company first submitted to shareholders an advisory vote on the compensation of its named executive officers in its 2011 proxy statement. At that time, the shareholders overwhelmingly supported the provision of the Say on Pay vote every year, which advisory vote was adopted

by the Board of Directors in 2011. Applicable law requires the Company to seek an advisory vote of the frequency of the Say on Pay vote at least once every six years, therefore we are providing this advisory vote on the frequency of the Say on Pay vote at the 2017 Annual Meeting.

What does the Board of Directors recommend for the frequency advisory vote on named executive officer compensation?

Since 2011, the advisory vote on say-on-pay for our named executive officers has achieved greater than 92% support from shareholders. The Executive Compensation Committee of the Board of Directors considers the advisory vote results each year in making compensation decisions for the following year. The Board of Directors believes that annual advisory votes provide shareholders

with the opportunity to voice support or concern regarding the named executive officer compensation on a more timely basis, which is why the Board of Directors is recommending that the shareholders select the annual frequency so that such annual Say on Pay votes will continue.

PROCESS FOR SUBMITTING SHAREHOLDER PROPOSALS FOR THE NEXT ANNUAL MEETING

Who can submit a shareholder proposal at an Annual Meeting?

Shareholders may submit proposals, which are proper subjects for inclusion in the Company’s Proxy Materials, which are this Proxy Statement and the form of proxy attached, for consideration at an

Annual Meeting of Shareholders, by following the procedures prescribed by Rule14a-8(e) of the Securities Exchange Act of 1934, as amended.

What is the deadline for submitting shareholder proposals for inclusion in the Company’s Proxy Materials for the next Annual Meeting?

To be eligible for inclusion in the Company’s Proxy Materials relating to the 20172018 Annual Meeting of Shareholders, proposals must be submitted in

writing and received by the Company at the address below no later than November 23, 2016.24, 2017.

What is the deadline for proposing business to be considered at the next Annual Meeting, but not to have the proposed business included in the Company’s Proxy Materials?

A shareholder of the Company may wish to propose business to be considered at an Annual Meeting of Shareholders, but not to have the proposed business included in the Company’s Proxy Materials relating to that meeting. Section 3.17 of the Company’s Bylaws requires that the Company receive written notice of business that a shareholder wishes to present for consideration at the 20172018 Annual Meeting of Shareholders (other than matters included in the Company’s Proxy Materials) not earlier than January 8, 2017 nor3, 2018 or later than February 7, 2017.2, 2018. The notice must meet certain other

other requirements set forth in the Company’s Bylaws. Copies of the Company’s Bylaws can be obtained by submitting a written request to the Secretary of the Company at the address below:

Proposals, notices and requests for copy by our Bylaws should be addressed as follows:

CORPORATE SECRETARY

AQUA AMERICA, INC.

762 W. LANCASTER AVENUE

BRYN MAWR, PAPA 19010

|

5 |

NOMINATING CANDIDATES FOR DIRECTOR

How does a shareholder nominate a director for election to the Board of Directors at the 20162017 Annual Meeting?

A shareholder entitled to vote for the election of directors may make a nomination for director provided that written notice (the “Nomination Notice”) of the shareholder’s intent to nominate a director at the meeting is filed with the Secretary of the Company prior to the 20162017 Annual Meeting in accordance with provisions of the Company’s Articles of Incorporation and Bylaws.

Section 4.14 of the Company’s Bylaws requires the Nomination Notice to be received by the Secretary of the Company not less than 14 days nor more than 50 days prior to any meeting of the shareholders called for the election of directors, with certain exceptions. These notice requirements do not apply to nominations for which proxies are solicited under applicable regulations of the SEC. The Nomination Notice must contain or be accompanied by the following information:

| 1. | Residence of the shareholder who intends to make the nomination; |

| 2. | A representation that the shareholder is a holder of record of voting stock and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the Nomination Notice; |

| 3. | Such information regarding each nominee as would have been required to be included in a proxy statement filed pursuant to the SEC’s proxy rules had each nominee been nominated, or intended to be nominated, by the management or the Board of Directors of the Company; |

| 4. | A description of all arrangements or understandings among the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; and |

| 5. | The consent of each nominee to serve as a director of the Company if so elected. |

What is the deadline for submitting a Nomination Notice for the 20162017 Annual Meeting?

Pursuant to the above requirements, a Nomination Notice for the 20162017 Annual Meeting must be

received by the Secretary of the Company no later than April 22, 2016.19, 2017.

CONSIDERATION OF DIRECTOR CANDIDATES

Who chooses director candidates?

The Corporate Governance Committee identifies, evaluates and recommends director candidates to our Board of Directors for nomination. The process followed by our Corporate Governance Committee to identify and evaluate director candidates includes

requests to current directors and others for recommendations, consideration of candidates proposed by shareholders, meetings from time to time to evaluate potential candidates and interviews of selectedpotential candidates.

|

6 |

How are director candidates evaluated?

In considering candidates for director, the Corporate Governance Committee will consider the candidates’ personal abilities, qualifications, independence, knowledge, judgment, character, leadership skills, education, background and their expertise and experience in fields and disciplines relevant to the Company, including financial expertise or financial literacy. When assessing a candidate, consideration will be given to the effect such candidate will have on the diversity of the Board. Diversity of the Board is evaluated by considering a broad range of attributes, such as background, demographic (including, without limitation, race, gender and national origin),

expertise and experience. Due consideration will also be given to the position the candidate holds at the time of his or her nomination and his or her capabilities to advance the Company’s interests with its various constituencies. The Corporate Governance Committee considers all of these qualities when selecting, subject to ratification by our Board of Directors, candidates for director.

The Corporate Governance Committee will evaluate shareholder-recommended candidates in the same manner as it evaluates candidates recommended by others.

What is the deadline for submitting a shareholder recommendation for a director candidate at the 20172018 Annual Meeting?

If you would like a director candidate considered by the Corporate Governance Committee for selection as a nominee at the 20172018 Annual Meeting, such recommendation should be submitted to the Chairperson of the Corporate Governance

Committee at least 120 days before the date on which the Company first mailed its proxy materials for the prior year’s Annual Meeting of Shareholders—that is, with respect to the 20172018 Annual Meeting, no later than November 23, 2016.24, 2017.

COMMUNICATIONS WITH THE COMPANY OR INDEPENDENT DIRECTORS

The Company receives many shareholder suggestions which are not in the form of proposals. All are given careful consideration. We welcome and encourage your comments and suggestions. Your correspondence should be addressed as follows:

CORPORATE SECRETARY

AQUA AMERICA, INC.

762 W. LANCASTER AVENUE

BRYN MAWR, PAPA 19010

In addition, shareholders or other interested parties may communicate directly with the independent directors or the lead independent director by writing

to the address set forth below. The Company will review all such correspondence and provide any comments along with the full text of the shareholder’s or other interested party’s communication to the independent directors or the lead independent director.

THE INDEPENDENT DIRECTORSOR

LEAD INDEPENDENT DIRECTOR

AQUA AMERICA, INC.

C/O CORPORATE SECRETARY

762 W. LANCASTER AVENUE

BRYN MAWR, PAPA 19010

|

7 |

All of the directors who are elected, will be elected for aone-year term expiring at the 20172018 Annual Meeting, and until their successors are duly elected and qualified. In accordance with the Company’s Corporate Governance Guidelines, the Chairperson of the Corporate Governance Committee reported to the Corporate Governance Committee that Carolyn J. Burke, Nicholas DeBenedictis, Christopher H. Franklin, Nicholas DeBenedictis, Carolyn J. Burke, Richard H. Glanton, Lon R. Greenberg, William P. Hankowsky, Wendell F. Holland, and Ellen T. Ruff would be willing to serve on the Board of Directors, if elected. The Corporate Governance Committee reviewed the qualifications of the directors in relation to the criteria for candidates for nomination for election to the Board of Directors under the Company’s Corporate Governance Guidelines. The Corporate Governance Committee voted to recommend to the Board of Directors, and the Board of Directors approved, the nomination of Mr. Franklin,Ms. Burke, Mr. DeBenedictis, Ms. Burke,Mr. Franklin, Mr. Glanton, Mr. Greenberg, Mr. Hankowsky, Mr. Holland, and Ms. Ruff for election as directors at the 20162017 Annual Meeting, with each nominee abstaining from the vote with respect to his or her nomination.

Therefore, eight directors will stand for election by a majorityplurality of the votes cast at the 20162017 Annual Meeting. At the 20162017 Annual Meeting, proxies in the accompanying form, properly executed, will be voted for the election of the nominees listed below, unless authority to do so has been withheld in the manner specified in the instructions on the proxy card or the record holder does not have discretionary voting power under the NYSE rules (see “What is the proxy?” on page 2 and “Proposals Under Consideration at This Meeting” on page 4). Discretionary authority is reserved to cast votes for the election of a substitute should any nominee be unable or become unwilling to serve as a director. Each nominee has stated his or her willingness to serve and the Company believes that the nominees will be available to serve.

INFORMATION REGARDING NOMINEES

For each of the eight nominees for election as directors at the 20162017 Annual Meeting, set forth below is information as to the positions and offices with the Company held by each, the principal occupation of each during at least the past five years, the directorships of public companies and other organizations held by each and the experience, qualifications, attributes or skills that, in the opinion of the Corporate Governance Committee and the Board of Directors, make the individual qualified to serve as a director of the Company. The chart below summarizes the experience, qualifications, attributes, and skills of each of the nominees.nominees:

Experience, Qualifications, Attributes and Skills | Utility Industry | Regulatory | Financial | Legal/ Government | Leadership | Mergers and Acquisitions | ||||||||||||||||||

| X | X | X | X | X | |||||||||||||||||||

DEBENEDICTIS | X | X | X | X | X | X | ||||||||||||||||||

| X | X | X | X | X | X | ||||||||||||||||||

GLANTON | X | X | X | |||||||||||||||||||||

GREENBERG | X | X | X | X | X | X | ||||||||||||||||||

HANKOWSKY | X | X | X | X | ||||||||||||||||||||

HOLLAND | X | X | X | X | X | |||||||||||||||||||

RUFF | X | X | X | X | X |

|

8 |

NOMINEES FOR ELECTION AT THE 20162017 ANNUAL MEETING

|

AGE: DIRECTORSINCE

MEMBER, M |

Biography:Biography Christopher H. Franklin is President and Chief Executive Officer of Aqua America. Previously, Mr. Franklin: Ms. Burke has served as the Executive Vice President, Strategy at Dynegy, Inc. since October 2016. In this role, she leads Dynegy’s strategic planning activities and is responsible for its clean technology strategy. Since October 2014, she has also served as Chief Integration Officer with overall responsibility for integration management, most recently integrating Dynegy’s acquisition of ENGIE’s US fossil portfolio. From July 2015 through October 2016, Ms. Burke served as Executive Vice President, and Chief Operating Officer, Regulated Operations (January 2012 to 2015); Regional President—Midwest and SouthernBusiness Operations and SeniorSystems at Dynegy with overall responsibility for Procurement, Safety, Environmental, Information Technology, Construction & Engineering, Outage Services and PRIDE-Dynegy’s signature continuous margin and process improvement program. From August 2011 to October 2014, Ms. Burke served as Dynegy’s Chief Administrative Officer over corporate functions including Communications, Human Resources, Information Technology, Investor Relations and Regulatory Affairs. Prior to joining Dynegy, Ms. Burke served as Global Controller for J.P. Morgan’s Global Commodities business. She was also NRG Energy’s Vice President Public Affairs (January 2010& Corporate Controller from 2006 to January 2012); Regional President—Southern Operations2008 and Senior Vice President, Public AffairsExecutive Director of Planning and Customer Relations (February 2007Analysis from 2004 to 2010); Vice President, Public Affairs and Customer Relations (May 2005 to February 2007); Vice President, Corporate and Public Affairs (1997 to May 2005); and Manager Corporate & Public Affairs (January 1992 to 1997).

Qualifications: Since joining Aqua America2006. Early in December 1992 as manager, corporate and public affairs, Mr. Franklin headed several successful projects, including advocacy forher career, she held various key financial roles at Yale University, the passage of legislation designed to provide customers of state-regulated water and wastewater utilities with improved water quality and better water and wastewater systems while allowing a fair and reasonable return for shareholders. Mr. Franklin also attained national print and broadcast media coverage for the company, changed the name and rebranded the company and its subsidiaries, and expanded its investor relations outreach to increase analyst coverage of the company. Before joining Aqua America, Mr. Franklin worked at PECO Energy Company (an Exelon company) where he was regional, civic and economic development officer, responsible for the review, recommendation and promotion of economic development initiatives in the Philadelphia region. Mr. Franklin earned his B.S. from West Chester University and his M.B.A. from Villanova University and serves on the board of directors of ITC Inc. (NYSE: ITC), where he chairs the board committee on operations and serves on the board audit committee. ITC is an electric transmission utility headquartered in Novi, Michigan. In addition, Mr. Franklin is active in the community and serves on the following nonprofit boards: University of Pennsylvania and at Atlantic Richfield Company. Ms. Burke graduated from Wellesley College with a BA in Economics and Political Science and earned her MBA at The University Chicago Booth School of Business.

Qualifications:Ms. Burke has over 20 years of experience in various roles within the energy and infrastructure industry with responsibilities ranging from accounting and finance, to information technology and human resources to operations and environmental compliance. The Board of Trustees, Philadelphia, PADirectors views Ms. Burke’s independence, her broad experience in finance and West Chester University’s Counciloperations, and her leadership roles within the industry as important qualifications, skills and experience that support the Board of Trustees, West Chester, PA.Directors’ conclusion that Ms. Burke should serve as a director of the Company.

| NICHOLAS DEBENEDICTIS NON-EXECUTIVE CHAIRMANOFTHE BOARDOF DIRECTORSAND FORMER CEO, AQUA AMERICA, INC.

AGE: DIRECTORSINCE 1992

MEMBER, EXECUTIVE COMMITTEE MEMBER, RISK MITIGATIONAND INVESTMENT POLICY COMMITTEE |

Biography:Mr. DeBenedictis retired as Chief Executive Officer of the Company on June 30, 2015 and currently serves asnon-executive Chairman of the Board, a position that he has held since July 2015. Mr. DeBenedictis has been Chairman of the Board since May 1993. Between April 1989 and June 1992, he served as Senior Vice President for Corporate Affairs of PECO Energy Company (an Exelon Corporation). From December 1986 to

|

9 |

April 1989, he served as President of the Greater Philadelphia Chamber of Commerce and from 1983 to 1986 he served as the Secretary of the Pennsylvania Department of Environmental Resources. Mr. DeBenedictis is a director of Exelon Corporation, P.H. Glatfelter Company and Mistras Group. He also serves on the Boards of Pennsylvania areanon-profit, civic and business organizations

Qualifications:In addition to his knowledge and experience as the Company’s Chief Executive Officer from 1992 to 2015, and his prior experience as a senior executive of a major electric utility, Mr. DeBenedictis has experience as the head of Pennsylvania’s environmental regulatory agency. He serves as a director of three other public companies, including, from time to time, as a member of the corporate governance, audit, finance and compensation committees of those companies. Mr. DeBenedictis has also held leadership positions with various, educational, business, civic and charitable institutions. The Board of Directors views Mr. DeBenedictis’ experience with various aspects of the utility industry and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience supporting the Board of Directors’ conclusion that Mr. DeBenedictis should serve as a director of the Company.

|

PRESIDENTAND CHIEFEXECUTIVE

AGE: DIRECTORSINCE 2015 MEMBER, RISK MITIGATIONAND INVESTMENT POLICY COMMITTEE |

BiographyBiography:: ThisChristopher H. Franklin is the first nomination of Carolyn Burke as a directorPresident and Chief Executive Officer of the Company. Ms. Burke servesPreviously, Mr. Franklin served as our Executive Vice President Businessand President and Chief Operating Officer, Regulated Operations (January 2012 to 2015); Regional President—Midwest and Southern Operations and Systems at Dynegy, Inc with overall responsibility for Supply Chain, Safety, Environmental, Information Technology, Construction & Engineering, Outage Services and PRIDE-Dynegy’s signature continuous margin and process improvement program. She also retains her role as Chief Integration Officer with overall responsibility for integration activities, most recently for Dynegy’s $6 billion EquiPower Corp. and Duke merchant portfolio acquisitions, and Dynegy’s project management office. From 2011 to 2014, Ms. Burke served as Dynegy’s Chief Administrative Officer with overall responsibility for corporate functions including Communications, Human Resources, Information Technology, Investor Relations and Regulatory Affairs. Prior to joining Dynegy, Ms. Burke served as Global Controller for J.P. Morgan’s Global Commodities business. She was also NRG Energy’sSenior Vice President, Public Affairs (January 2010 to January 2012); Regional President—Southern Operations and Senior Vice President, Public Affairs and Customer Relations (February 2007 to 2010); Vice President, Public Affairs and Customer Relations (May 2005 to February 2007); Vice President, Corporate Controllerand Public Affairs (1997 to May 2005); and Manager Corporate & Public Affairs (December 1992 to 1997).

Qualifications:Since joining the Company in December 1992 as manager, corporate and public affairs, Mr. Franklin headed several successful projects, including advocacy for the passage of legislation designed to provide customers of state-regulated water and wastewater utilities with improved water quality and better water and wastewater systems while allowing a fair and reasonable return for shareholders. Mr. Franklin also attained national print and broadcast media coverage for the Company changed the name and rebranded the Company and its subsidiaries, and expanded its investor relations outreach to increase analyst coverage of the Company. Before joining the Company, Mr. Franklin worked at PECO Energy Company (an Exelon company) where he was regional, civic and economic development officer, responsible for the review, recommendation and promotion of economic development initiatives in the Philadelphia region. Mr. Franklin earned his B.S. from 2006 to 2008West Chester University and Executive Director of Planninghis M.B.A. from Villanova University. In addition, Mr. Franklin is active in the community and Analysis from 2004 to 2006. Early in her career, she held various key financial roles at Yale University,serves on the following nonprofit boards: University of Pennsylvania and at Atlantic Richfield Company (now British Petroleum). Ms. Burke graduated from Wellesley College with a BA in Economics and Political Science and earned her MBA at The University Chicago Booth School of Business.

Qualifications:Ms. Burke has over 20 years of experience in various roles within the energy and infrastructure industry with responsibilities ranging from accounting and finance, to information technology and human resources to operations and environmental compliance. The Board of Directors views Ms. Burke’s independence, her broad experience in financeTrustees, Philadelphia, PA and operations, and her leadership roles within the industry as important qualifications, skills and experience that support the BoardWest Chester University’s Council of Directors’ conclusion that Ms. Burke should serve as a director of the Company.Trustees, West Chester, PA.

|

10 |

| RICHARD H. GLANTON LEAD INDEPENDENT DIRECTOR, AQUA AMERICA, INC. FOUNDER,CHAIRMANAND CEO, ELECTEDFACE INC.

AGE: DIRECTORSINCE 1995

MEMBER, EXECUTIVE COMMITTEE CHAIR, RISK MITIGATIONAND INVESTMENT POLICY COMMITTEE |

Biography:Mr. Glanton is Founder, Chairman and Chief Executive Officer of ElectedFace Inc., anon-line social media website which consolidates 21 of the most proven and popular social media features and functions into one platform to connect individuals and organizations of all types, including government officials and agencies, educational institutions and their leaders, businesses, faith groups, cultural icons and establishments, and community organizations and associations. Mr. Glanton was Senior Vice President of Corporate Development at Exelon Corporation from 2003 to 2008. From 1983 to 2003, he was a partner at the law firms of Wolf Block LLP (1983 to 1986) and Reed Smith LLP (1986 to 2003). Mr. Glanton is a director of The GEO Group, Inc. and Mistras Group, Inc.

Qualifications:Mr. Glanton has more than 25 years of legal experience in law firms and 13 years of executive experience as President of The Barnes Foundation for more than eight years from 1990 to 1998 and at Exelon Corporation. Mr. Glanton has approximately 29 years of continuous experience serving on boards of publicly traded companies. He has served as a director on boards of five publicly traded companies, four of which are traded on the NYSE and one, CGU, is traded on the United Kingdom Stock Exchange. He served as a Directordirector of CGU of North America, a British-based Insurance Company, from 1983 to 2003 when it was sold to White Mountain Group of Exeter, New Hampshire and Berkshire Hathaway. He was a member of both its Executive and Audit Committees during his20-year tenure on that board. From 1990 until 2003, he served as Directora director of PECO Energy/Exelon Corporation Boards until he resigned to assume a senior management position within the company at the request of its Chairman. He served on the Executive, Audit and Governance Committees of PECO/Exelon. He has been a director of the GEO Group since 1998, where he serves on its three member Executive Committee, and as Chairman of the Audit and Finance Committee and a member of its Governance and Compensation Committees. The Board has determined that Mr. Glanton is an independent director. The Board of Directors views Mr. Glanton’s independence, his experience in utility acquisitions, his experience as a director of other publicly traded companies and his demonstrated leadership roles in other business activities as important qualifications, skills and experience that support the Board of Directors’ conclusion that Mr. Glanton should serve as a director of the Company.

| LON R. GREENBERG CHAIRMAN EMERITASOFTHE BOARDAND RETIRED CEO, UGI CORPORATION

AGE: DIRECTORSINCE 2005

CHAIR, EXECUTIVE COMPENSATION COMMITTEE MEMBER, EXECUTIVE COMMITTEE MEMBER, AUDIT COMMITTEE |

Biography:Mr. Greenberg is Chairman Emeritus of UGI Corporation. He retired from his position asnon-executive Chairman of the Board of Directors of UGI Corporation on January 28, 2016, where he served as Chairman since August 1996 and Chief Executive Officer since August 1995, until his retirement in April 2013. He was formerly President (July 1994 to

|

11 |

He was formerly President (July 1994 to August 2005), Vice Chairman of the Board (1995 to 1996) and Senior Vice President – Legal and Corporate Development (1989 to 1994) of UGI Corporation. Mr. Greenberg is a member of the Board of Trustees of Temple University, and the Chairman of the Board of Trustees of the Temple University Health System.System, and a member of the Board of Trustees of Fox Chase Cancer Center. Mr. Greenberg also is a member of the Board of Directors of The United Way of Greater Philadelphia and Southern New Jersey and of the Board of Managers of The Philadelphia Foundation. Mr. Greenberg serves as a director of Ameriprise Financial, Inc. and AmerisourceBergen Corporation.

Qualifications:Mr. Greenberg has over 2030 years of experience in various executive, legal and corporate development roles with a major gasNYSE listed regulated utility, andnon-regulated energy servicesdistribution company and international distributor of propane.propane, where he also served as Chairman and Chief Executive Officer for 18 years. He was also Chairman of the nation’s largest retail propane marketer and hepresently serves as a director for a NYSE listed financial planning, products and services company, as well as a NYSE listed global pharmaceutical sourcing and distribution services company. He is a member of the Board of Trustees of a major university in Philadelphia and the university’s health system. Mr. Greenberg has served as a member of the Company’s Executive Compensation Committee since 2005, and was appointed Committee Chairman in 2015. He has served as a member of the Company’s Audit Committee since 2009, serving as Chairman from 2012 through 2015. Mr. Greenberg has also held leadership positions with various civic and charitable institutions. The Board of Directors has determined that Mr. Greenberg is an independent director, financially literate and an audit committee financial expert within the meaning of applicable SEC rules. The Board of Directors views Mr. Greenberg’s independence, his experience with various aspects of the utility industry, his experience as an executive of anon-utility business and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience that support the Board of Directors’ conclusion that Mr. Greenberg should serve as a director of the Company.

| WILLIAM P. HANKOWSKY CHAIRMAN, PRESIDENTAND CEO, LIBERTY PROPERTY TRUST

AGE: DIRECTORSINCE 2004

CHAIR, AUDIT COMMITTEE MEMBER, EXECUTIVE COMMITTEE MEMBER, CORPORATE GOVERNANCE COMMITTEE

|

Biography:Mr. Hankowsky has been Chairman, President and Chief Executive Officer of Liberty Property Trust, a fully integrated real estate firm, since 2003. Mr. Hankowsky joined Liberty in 2001 as Executive Vice President and Chief Investment Officer. Prior to joining Liberty, he served for 11 years as President of the Philadelphia Industrial Development Corporation. Prior to that, he was Commerce Director for the City of Philadelphia. Mr. Hankowsky serves on the Board of Directors of Citizens Financial Group and on various charitable and civic boards, including the Greater Philadelphia Convention and Visitors BureauChamber of Commerce and the Pennsylvania Academy of Fine Arts.

Qualifications:Mr. Hankowsky has over 35 years of experience managing public, private andnon-profit organizations, including eleven years as Chairman and Chief Executive Officer of Liberty Property Trust, a publicly traded Real Estate Investment Trust which owns 100 million square feet of office and industrial space in over 24 markets throughout the United States and the United Kingdom. He has experience in financing, acquisitions and real estate matters across the United States. Mr. Hankowsky has also held leadership positions with various cultural and civic institutions in the greater Philadelphia region. Mr. Hankowsky has served as Chairman of the Company’s Executive Compensation Committee from 2005 through 2015, and presently serves as Chairman of the Company’s Audit Committee. The Board of Directors has determined that Mr. Hankowsky is an independent director, financially literate and an audit committee financial expert within the meaning of

12 |

applicable SEC rules. The Board of Directors views Mr. Hankowsky’s independence, his experience with real estate, financing and acquisitions and his demonstrated leadership roles in business and community activities as important qualifications, skills and experience supporting the Board of Directors’ conclusion that Mr. Hankowsky should serve as a director of the Company.

|

|

| WENDELL F. HOLLAND PARTNER, CFSD GROUP, LLC

AGE: DIRECTORSINCE 2011

MEMBER, CORPORATE GOVERNANCE COMMITTEE MEMBER, RISK MITIGATIONAND INVESTMENT POLICY COMMITTEE |

Biography:Mr. Holland has been a partner in CFSD Group, LLC, advisors for local and regional utility financing, since July 2009. Mr. Holland was partner in the law firm of Saul Ewing, LLP from October 2008 to September 2013. Mr. Holland served as Chairman of the Pennsylvania Public Utility Commission from 2004 to 2008 and as a Commissioner from 1990 to 1993, and 2003 to 2004. Mr. Holland was Of Counsel to the law firm of Obermayer Rebman from 1999 to 2003, Vice President of American Water Works Company from 1996 to 1999 and a partner at the law firm of LeBoeuf Lamb Greene and McRae from 1993 to 1995. He has served as Treasurer of the National Association of Utility Regulatory Commissioners (NARUC) and also served on NARUC’s Executive Committee, Board of Directors, and as Chairman of its Audit and Investment Committees. He is a member of the Boarddirector of Bryn Mawr Trust Bank and was a member of the Allegheny Energy Board of Directors from 1994 to 2003.

Qualifications:Mr. Holland has extensive knowledge and experience in the regulation of public utilities, especially water utilities. His experience as chairman of the Public Utility Commission in Pennsylvania for four years and a Commissioner for an additional four years enables him to provide valuable insight into the regulatory process. His prior service as a member of the Board of Directors of a large, publicly traded energy company also enables him to play a meaningful role on the Company’s Board of Directors. As outside counsel to, and an executive at other public utility companies, he has a valuable perspective on the various issues facing public utility companies. The Board of Directors has determined that Mr. Holland is an independent director. The Board of Directors views Mr. Holland’s independence, his experience with utility regulation and utility operations, his reputation in the utility industry and his leadership roles in business and community activities as important qualifications, skills and experience supporting the Board of Directors’ conclusion that Mr. Holland should serve as a director of the Company.

13 |

| ELLEN T. RUFF PARTNER, MCGUIREWOODS, LLPAND FORMER PRESIDENT, DUKE ENERGY

AGE: DIRECTORSINCE 2006

CHAIR, CORPORATE GOVERNANCE COMMITTEE MEMBER, EXECUTIVE COMMITTEE MEMBER, EXECUTIVE COMPENSATION COMMITTEE MEMBER, AUDIT COMMITTEE |

Biography: Ms. Ruff is a partner in the law firm of McGuireWoods, LLP. She was President, Office of Nuclear Development, for Duke Energy Corporation, from December 2008 until her retirement in January 2011. Duke Energy Corporation is a leading energy company focused on electric power and gas distribution operations and other energy services in the Americas. From April 2006 through December 2008, Ms. Ruff was President of Duke Energy Carolinas, an electric utility that provides electricity and other services to customers in North Carolina and South Carolina. Ms. Ruff joined the Duke Energy organization in 1978 and during her career held a number of key positions, including: Vice President and General Counsel of Corporate, Gas and Electric

|

|

Operations; Senior Vice President and General Counsel for Duke Energy; Senior Vice President of Asset Management for Duke Power; Senior Vice President of Power Policy and Planning; and Group Vice President of Planning and External Affairs. Ms. Ruff is a retired director of Mistras Group, Inc.

Qualifications:Ms. Ruff has over 30 years of experience with a major utility company in various management, operations, legal planning and public affairs positions. Ms. Ruff has lived and worked in North Carolina, an important area of the Company’s operations, for many years. Ms. Ruff has served as a member of the Company’s Executive Compensation Committee since 2006. The Board of Directors has determined that Ms. Ruff is an independent director. The Board of Directors views Ms. Ruff’s independence, her experience with various aspects of the utility industry, her knowledge of North Carolina and her demonstrated leadership roles in business and community activities as important qualifications, skills and experience supporting the Board of Directors’ conclusion that Ms. Ruff should serve as a director of the Company.

|

14 |

The Board of Directors operates pursuant to a set of written Corporate Governance Guidelines. Copies of these Guidelines can be obtained free of charge from the Corporate Governance portion of the Investor Relations section of the Company’s website,www.aquaamerica.com. Our website is not part of this Proxy Statement. References to our website address in this Proxy Statement are intended to be inactive textual references only.

In accordance with best practices and its commitment to strong corporate governance, in 2015 the Board of Directors retained a renowned corporate governance advisor to review the Company’s corporate governance guidelines and practices. In the fall of 2015, the Board of Directors adopted the following changes to its corporate governance practices:

In addition, the Board of Directors continues to focus on succession planning as an important component of good governance. The search for and recruitment of Carolyn J. Burke as a nominee to join the Company’s Board of Directors is a result of that commitment.

DIRECTOR INDEPENDENCE

The Board of Directors is, among other things, responsible for determining whether each of the directors is independent in light of any relationship such director may have with the Company. The Board has adopted Corporate Governance Guidelines that contain categorical standards of director independence that are consistent with the listing standards of the NYSE. Under the Company’s Corporate Governance Guidelines, a director will not be deemed independent if:

The director is an executive officer or employee, or someone in her/his immediate family is an executive officer, of another company that, during any of the other company’s past three fiscal years

made payments to, or received payments from, the Company for property or services in an amount which, in any single fiscal year of the other company, exceeded the greater of $1 million or 2% of the other company’s consolidated gross revenues; or |

|

|

For purposes of the categorical standards set forth above, (a) a person’s immediate family includes a person’s spouse, parents, children, siblings, mothers- andfathers-in-law, sons- anddaughters-in-law, and brothers- andsisters-in-law and anyone (other than domestic employees) who shares such person’s home, (b) the term “executive officer” has the same meaning specified for the term “officer” in Rule16a-1(f) under the Exchange Act, and (c) the “Company” includes Aqua and its consolidated subsidiaries.

15 |

In addition to these categorical standards, no director will be considered independent unless the Board of Directors affirmatively determines that the director has no material relationship with the Company (either directly, or as a partner, stockholder, director or officer, of an organization that has a relationship with the Company). When making independence determinations, the Board of Directors broadly considers all relevant facts and circumstances surrounding any relationship between a director or nominee and the Company. Transactions, relationships and arrangements between directors or members of their immediate family and the Company that are not addressed by the categorical standards may be material depending on the relevant facts and circumstances of such transactions, relationships and arrangements. The Board of Directors considered the following transactions, relationships and arrangements in connection with making the independence determinations for the current board of directors:

| 1. | The Company made contributions to charitable or civic organizations for which the following directors serve as directors, trustees or executive officers: Mr. Glanton, Mr. Greenberg, and Mr. Hankowsky. None of the Company’s contributions exceeded the greater of $1 million or 2% of the recipient organization’s consolidated gross revenues. |

| 2. | The Company |

| The Company has banking arrangements with Citizens Financial Group or its affiliates, and Mr. Hankowsky is a member of the Board of Directors of Citizens Financial Group. The amounts paid by the Company to Citizens Financial Group or its affiliates are not material to these |

| 4. | The Company has insurance arrangements with Independence Health Group or its affiliates, and Mr. DeBenedictis is a member of the Board of Directors of Independence Health Group. The amounts paid by the Company to Independence Health Group are not material to these entities or to the Company. |

Based on a review applying the standards set forth in the Company’s Corporate Governance Guidelines and considering the relevant facts and circumstances of the transactions, relationships and arrangements between the directors and the Company described above, the Board of Directors has affirmatively determined that each nominee for director, other than Mr. Franklin, the Company’s Chief Executive Officer, and Mr. DeBenedictis, the Company’s former Chief Executive Officer, is independent.

|

|

BOARDOF DIRECTORS LEADERSHIP STRUCTURE

Mr. Franklin serves as Chief Executive Officer and Mr. DeBenedictis serves as thenon-executive Chairman of the Board. The Board of Directors believes this structure provides continuity and efficiency for the Company and best utilizes the skills and experience of Mr. Franklin and Mr. DeBenedictis.

Under this present structure, the Board of Directors annually elects a lead independent director to coordinate the activities of the other independent directors and enhance the role of the independent directors in the overall corporate governance of the Company. Mr. Glanton is currently the Lead Independent Director.

The duties and powers of the lead independent director include:

16 |

AGEAND TERM LIMITS

The Board believes that term limits are an important element of good governance. However, it also believes that it must strike the appropriate balance between the contribution of directors who have developed, over a period of time, meaningful insight into the Company and its operations, and therefore can provide an increasing contribution to the Board as a whole. Accordingly, in 2015 the Board established that upon the fifteenth anniversary of a director accepting an initial appointment or election to the Board of Directors, the director shall tender his or her resignation to the Board (the “Term Limit Policy”). The Term Limit Policy does not apply to Directorsdirectors who were elected on or before December 1, 2015.

The Board also believes that our current policy of retirement for directors at age 72 is in the best interests of the Company.appropriate. All directors are required to submit their resignation from the Board effective as of their 72ndbirthday.

OVERSIGHTOF RISK MANAGEMENT

The Board oversees management’s risk management activities through a combination of processes:

In 2015, the Board createdPursuant to its charter, the Risk Mitigation and Investment Policy Committee. Pursuant to its charter, theCommittee’s primary purpose of Risk Mitigation and Investment Policy Committee is to assist the Board of Directors in fulfilling its oversight responsibilities with respect to the Company’s risk management

|

|

practices, the Company’s compliance with legal and regulatory requirements, the Company’s potential investments in acquisitions and growth vehicles, and to review and approve the Company’s risk management framework. |

At least quarterly, the Risk Mitigation and Investment Policy Committee reviews this Enterprise Risk Managementthe results of the Company’s enterprise risk management process and management presents to the Board a report on the status of the risks and the metrics used to monitor those risks. Each risk that is tracked as part of the Enterprise Risk Managemententerprise risk management process has a member of the Company’s management who serves as the owner and monitor for that risk. The risk owners and monitors report on the status of their respective risks at the quarterly meeting of management’s Compliance Committee. The information discussed at the Compliance Committee meeting is then reviewed by the Disclosure Committee composed of the Company’s Chief Executive Officer, Chief Financial Officer, General Counsel, Chief Accounting Officer and Director of Internal Audit. The results of the Disclosure Committee’s meetings are presented to the Risk Mitigation and Investment Policy Committee or the Audit Committee each quarter, as appropriate.

17 |

the Compliance Committee meeting is then reviewed by the Disclosure Committee composed of the Company’s Chief Executive Officer, Chief Financial Officer, General Counsel, Chief Accounting Officer and Director of Internal Audit. The results of the Disclosure Committee’s meetings are presented to the Risk Mitigation and Investment Policy Committee or the Audit Committee each quarter, as appropriate. |

|

|

The Board believes that the present leadership structure, along with the important risk oversight functions performed by management, the Audit Committee, the Risk Mitigation and Investment Policy Committee, the Executive Compensation Committee, and the full Board, permits the Board to effectively perform its role in the risk oversight of the Company.

18 |

CODEOF ETHICS

The Company maintains a Code of Ethical Business Conduct for its directors, officers and employees, including the Company’s Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as defined by the rules adopted by the SEC pursuant to Section 406(a) of the Sarbanes-Oxley Act of 2002. The Code of Ethical Business Conduct covers a number of important subjects, including: conflicts of interest; corporate opportunities; fair dealing; confidentiality; protection and proper use of Company assets; compliance with laws, rules and regulations (including insider trading laws); and encouraging the reporting of illegal or unethical behavior. Copies of the Company’s Code of Ethical Business Conduct can be obtained free of charge from the Corporate Governance portion of the Investor Relations section of the Company’s website,www.aquaamerica.com. The Company intends to post amendments to or waivers from the Code of Ethical Business Conduct (to the extent applicable to the Company’s executive officers, senior financial officers or directors) on its website.

ANTI-HEDGINGAND ANTI-PLEDGING POLICY

We believe that issuance of incentive and compensatory equity awards to our named executive officers along with our stock ownership guidelines help to align the interests of such officers with our shareholders. As part of our insider trading policy, we prohibit any officers from engaging in hedging or pledging activities with respect to any owned shares or outstanding equity awards. Such policy also discourages pledges of any Company stock by officers, and requires Company notice and approval. None of our named executive officers pledged any shares of Company stock during 2015.2016. None of our named executive officers engaged in any hedging activities with respect to the Company stock during 2016.

POLICIESAND PROCEDURESFOR APPROVALOF RELATED PERSON TRANSACTIONS

The Board has a written policy with respect to related person transactions to document procedures pursuant to which such transactions are reviewed, approved or ratified. The policy applies to any transaction in which: (1) the Company is a participant, (2) any related person has a direct or indirect material interest, and the annual amount involved exceeds $120,000, but excludes certain types of transactions in which the related person is deemed not to have a material interest.

Under this policy, a related person means: (a) any person who is, or at any time since the beginning of the Company’s last fiscal year was, a director, an executive officer or a director nominee; (b) any person known to be the beneficial owner of more than 5% of any class of the Company’s voting securities; (c) any immediate family member of a person identified in items (a) or (b) above, meaning such person’s spouse, parent, stepparent, child, stepchild, sibling, mother- orfather-in-law,son- ordaughter-in-law, brother- orsister-in-law or any other individual (other than a tenant or employee) who shares the person’s household; or (d) any entity that employs any person identified in (a), (b) or (c) or in which any person identified in (a), (b) or (c) directly or indirectly owns or otherwise has a material interest.

The Corporate Governance Committee, with assistance from the Company’s General Counsel, is responsible for reviewing, approving and ratifying any related person transaction. In its review and approval or ratification of related person transactions (including its determination as to whether the related person has a material interest in a transaction), the Corporate Governance Committee will consider, among other factors:

|

|

19 |

The Corporate Governance Committee intends to approve only those related person transactions that are in, or are not inconsistent with, the best interests of the Company and its shareholders.

BOARDAND BOARD COMMITTEES

The Company’s Bylaws provide that the Board of Directors, by resolution adopted by a majority of the whole Board, may designate an Executive Committee and one or more other committees, with each such committee to consist of two or more directors except for the Audit Committee and Executive Compensation Committee, which must have at least three members. The Board of Directors annually elects from its members the Executive, Audit, Executive Compensation, Risk Mitigation and Investment Policy, and Corporate Governance Committees. The Board may also from time to time appoint ad hoc committees such as an Executive Search Committee to oversee the Company’s succession planning activities. The Retirement and Employee Benefits Committee, which is comprised of senior management of the Company, reports periodically to the Board of Directors.

Michael L. Browne, a member of the Board of Directors since 2013, served as a member of the Board of Directors during 2015. He resigned from the Board of Directors on March 11, 2016. At the time of his resignation, Mr. Browne was a member of the Company’s Audit Committee and its Executive Compensation Committee. The Board subsequently filled the vacancies on March 15, 2016.

The Board of Directors held twelve (12)twenty two (22) meetings in 2015.2016. Each director attended at least 75% of the aggregate of all meetings of the Board and the Committees on which each such director served in 2015.2016. The Board of Directors encourages all directors to attend the Company’s Annual Meeting of Shareholders. All the directors were in attendance at the 20152016 Annual Meeting of Shareholders.

Each of the standing Committees of the Board of Directors operates pursuant to a written Committee Charter. Copies of these Charters can be obtained free of charge from the Corporate Governance portion of the Investor Relations section of the Company’s website,www.aquaamerica.com. The members of the standing Committees of the Board of Directors, as of December 31, 2015,2016, were as follows:

| Name | Executive Committee | Executive Compensation Committee | Audit Committee | Risk Mitigation Investment | Corporate Governance Committee | |||||||||||||||||

| X | X | ||||||||||||||||||||

DEBENEDICTIS | Chair | X | ||||||||||||||||||||

| X | |||||||||||||||||||||

GLANTON | X | Chair | ||||||||||||||||||||

GREENBERG | X | Chair | X | |||||||||||||||||||

HANKOWSKY | X | Chair | X | |||||||||||||||||||

HOLLAND | X | X | ||||||||||||||||||||

RUFF | X | X | Chair |

|

|

EXECUTIVE COMMITTEE

The Company’s Bylaws provide that the Executive Committee shall have and exercise all of the authority of the Board in the management of the business and affairs of the Company, with certain specified exceptions. The Executive Committee is intended to serve in the event that action by the Board of Directors is necessary or desirable between regular meetings of the Board, or at a time when convening a meeting of the entire Board is not practical, and to make recommendations to the entire Board with respect to various matters. The Executive Committee currently has five members, and the Chairman of the Board of Directors serves as Chairman of the Executive Committee. The Executive Committee met oncedid not meet in 2015.2016.

20 |

AUDIT COMMITTEE

The Audit Committee is composed of three directors, whom the Board of Directors has affirmatively determined meet the standards of independence required of audit committee members by the NYSE listing requirements and applicable SEC rules. Based on a review of the background and experience of the members of the Audit Committee, the Board of Directors has determined that, currently, all members of the Audit Committee, except for Ms. Ruff, are financially literate and aretwo members of the audit committee are financial experts within the meaning of applicable SEC rules. The Audit Committee operates pursuant to a Board-approved charter which states its duties and responsibilities. The primary responsibilities of the Audit Committee are to monitor the integrity of the Company’s financial reporting process and systems of internal controls, including the review of the Company’s annual audited financial statements, and to monitor the independence of the Company’s independent registered public accounting firm. The Audit Committee is required to meet at least four times during the year and met four10 times during 2015.2016.

The Audit Committee has the exclusive authority to select, evaluate and, where appropriate, replace the Company’s independent registered public accounting firm. The Audit Committee has considered the extent and scope ofnon-audit services provided to the Company by its independent registered public accounting firm and has determined that such services are compatible with the independent registered public accounting firm maintaining its independence.

EXECUTIVE COMPENSATION COMMITTEE

The Executive Compensation Committee is composed of three directors, whom the Board of Directors has affirmatively determined are independent directors as defined by the NYSE listing requirements and applicable SEC rules. The Executive Compensation Committee operates pursuant to a Board-approved charter which states its duties and responsibilities. The Executive Compensation Committee has the power to, among other things, administer and make awards under the Company’s equity compensation plans. The Executive Compensation Committee reviews the recommendations of the Company’s Chief Executive Officer as to appropriate compensation of the Company’s executive officers (other than the Chief Executive Officer) and determines the compensation of such executive officers. The Executive Compensation Committee reviews and recommends to the Board of Directors the compensation for the Company’s Chief Executive Officer, which is subject to final approval by the independent members of the Board of Directors. The Executive Compensation Committee has the power to delegate aspects of its work to subcommittees, with the approval of the Board of Directors. The Executive Compensation Committee met five10 times during 2015.2016.

CORPORATE GOVERNANCE COMMITTEE

The Corporate Governance Committee is composed of three directors, whom the Board of Directors has affirmatively determined are independent directors as defined by the NYSE listing requirements. The Corporate Governance Committee operates pursuant to a Board-approved charter which states its duties and responsibilities, which include identifying and considering qualified nominees for directors, and developing and periodically reviewing the Corporate Governance Guidelines by which the Board of Directors is organized and executes its responsibilities. The Corporate Governance Committee advises the Board of Directors on director nominees, executive

|

|

selections and succession, including ensuring that there is a succession plan for the Chief Executive Officer and such other senior executives as determined by the Corporate Governance Committee. TheIn 2016, the Corporate Governance Committee initiated and oversaw the implementation of a comprehensive Board, Committee, and Peer review process. It also reviews and approves, ratifies or rejects related person transactions under the Company’s written policy with respect to related person transactions. The Corporate Governance Committee met five8 times during 2015.2016.

RISK MITIGATIONAND INVESTMENT POLICY COMMITTEE

The Risk Mitigation and Investment Policy Committee was formed on December 1, 2015 and is composed of four directors and the Company’s Chief Financial Officer. The Risk Mitigation and Investment Policy Committee operatesoperate pursuant to a Board

21 |

approved charter, which states its duties and responsibilities. The Committee oversees the Company’s risk management process, policies, and procedures for identifying, managing and monitoring critical risks, including cyber related risks, and its compliance with legal and regulatory requirements. The Committee also oversees the Company’s acquisition process in which it reviews all acquisitions valued in excess of $10 million. The Committee communicates with other Board of Directors Committees to avoid overlap and potential gaps in overseeing the Company’s risks. The Risk Mitigation and Investment Policy Committee advises the Board of Directors in its performance of its oversight of enterprise risk management. The Risk Mitigation and Investment Policy Committee met once during 2015.

EXECUTIVE SEARCH COMMITTEE

During 2015, the Board of Directors had an ad hoc Executive Search Committee composed of all eight directors, chaired by Mr. Glanton, the lead independent director, which was charged with oversight of the Company’s succession planning activities. The Executive Search Committee Chairman held separate meetings on fourteen occasions and the Executive Search Committee met eight9 times during 2015.2016.

22 |

In December 2015, the Board of Directors approved a revised directors’ compensation program effective January 1, 2016. Upon the recommendation of its Executive Compensation Committee, the Board of Directors approved the following directors’ compensation for 2016 for thenon-employee directors of Aqua America, Inc.: (1) an annual cash retainer of $75,000; (2) an annual cash retainer for the Chair of the Executive Compensation Committee of $12,500; (3) an annual cash retainer for the Chair of the Audit Committee of $12,500; (4) an annual cash retainer for the Chair of the Corporate Governance Committee of $10,000; (5) an annual cash retainer for the Chair of the Risk Mitigation Committee of $10,000; (6) an annual cash retainer for the Lead Independent Director of $25,000; (7) an annual stock grant to directors of $75,000; and (8) the non-executive Chairman shall be paid a retainer in the amount of $175,000 per year and the normal director equity award as set forth above. Company:

| DIRECTOR COMPENSATION | ||||||

| Role | Annual Cash Compensation | Annual Equity Compensation | ||||

Each Independent Director | $ | 75,000 | Stock grant equal to $75,000 in value | |||

Chair, Audit Committee | $ | 12,500 | — | |||

Chair, Executive Compensation Committee | $ | 12,500 | — | |||

Chair, Corporate Governance Committee | $ | 10,000 | — | |||

Chair, Risk Mitigation Committee | $ | 10,000 | — | |||

Lead Independent Director | $ | 25,000 | — | |||

Non-Executive Chairman | $ | 175,000 | — | |||

All directors are reimbursed for reasonable expenses incurred in connection with attendance at Board or Committee meetings.

As a component of this program, the Board of Directors approved share ownership guidelines for each director to own shares of Company common stock having a value equal to five times the annual base cash retainer for directors. Directors have up to three years from December 2015 or upon appointment, whichever is later, to attain this new guideline share ownership level.

|

|

The following table sets forth the compensation paid to the Aqua America Board of Directors in 2015:2016:

| DIRECTOR COMPENSATION | ||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | Non-Equity Incentive Plan Compen- sation ($)($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compen- sation ($) | Total ($) | |||||||||||||||||||||

Nicholas DeBenedictis (3) | — | — | — | — | — | — | — | |||||||||||||||||||||

Michael L. Browne | 94,250 | 60,811 | — | — | — | — | 155,061 | |||||||||||||||||||||

Richard H. Glanton | 139,500 | 60,811 | — | — | — | — | 200,311 | |||||||||||||||||||||

Lon R. Greenberg | 101,625 | 60,811 | — | — | — | — | 162,436 | |||||||||||||||||||||

William P. Hankowsky | 109,125 | 60,811 | — | — | — | — | 169,936 | |||||||||||||||||||||